Quality review reports in a fraction of the time

The FCA's long-awaited statement on ongoing advice services has been released. The results they found were largely positive, but the FCA's emphasis on increasing the quality and consistency of reviews and oversight is clear.

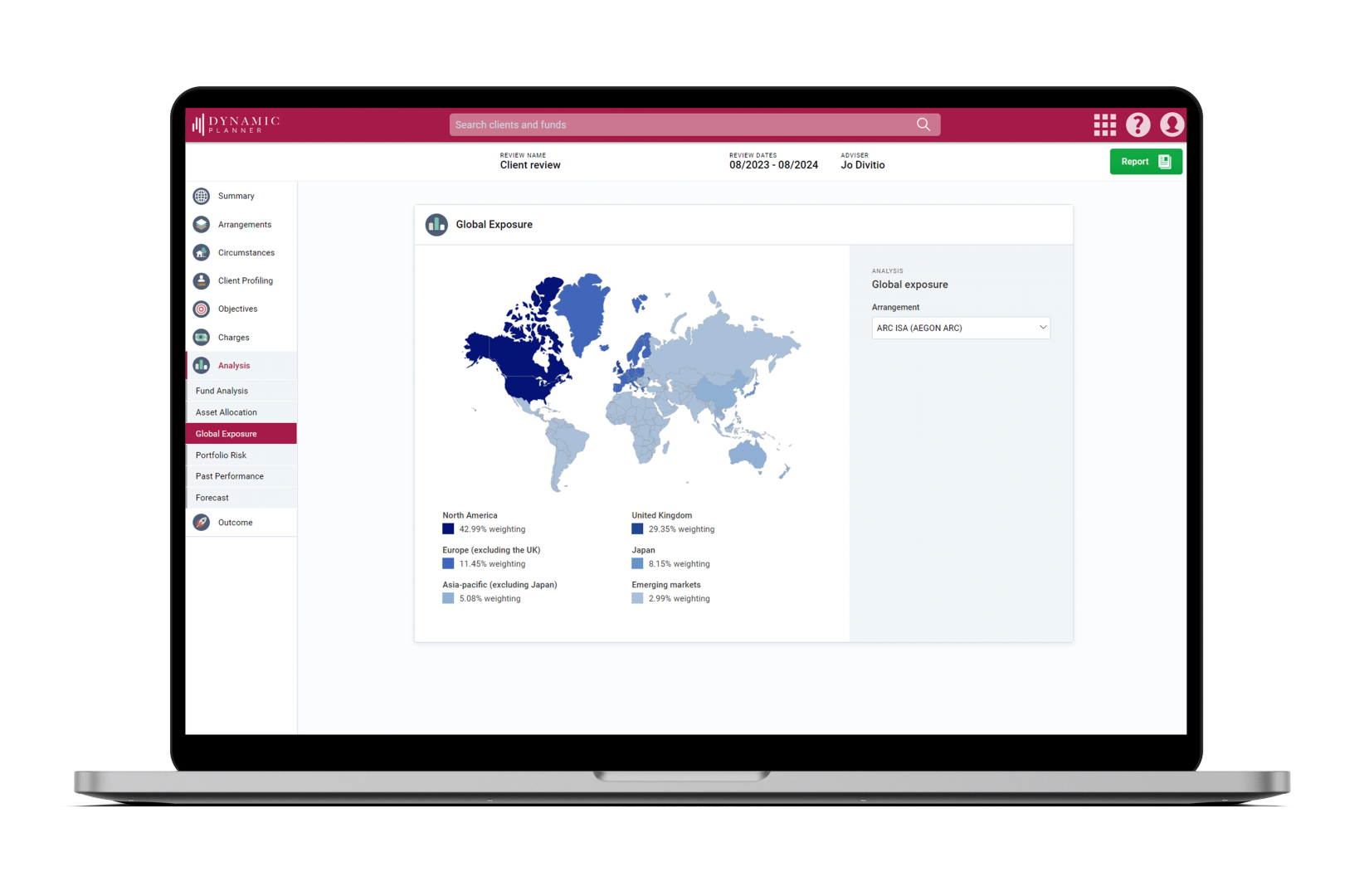

Dynamic Planner supports over 40% of the UK's financial advisers, helping them maintain a high standard of quality in their client reviews, meeting and exceeding regulatory requirements.

We're pleased to offer a highly efficient process, with 80% of Client Review reports taking under 31 minutes to create, and 20% taking under 5 minutes.

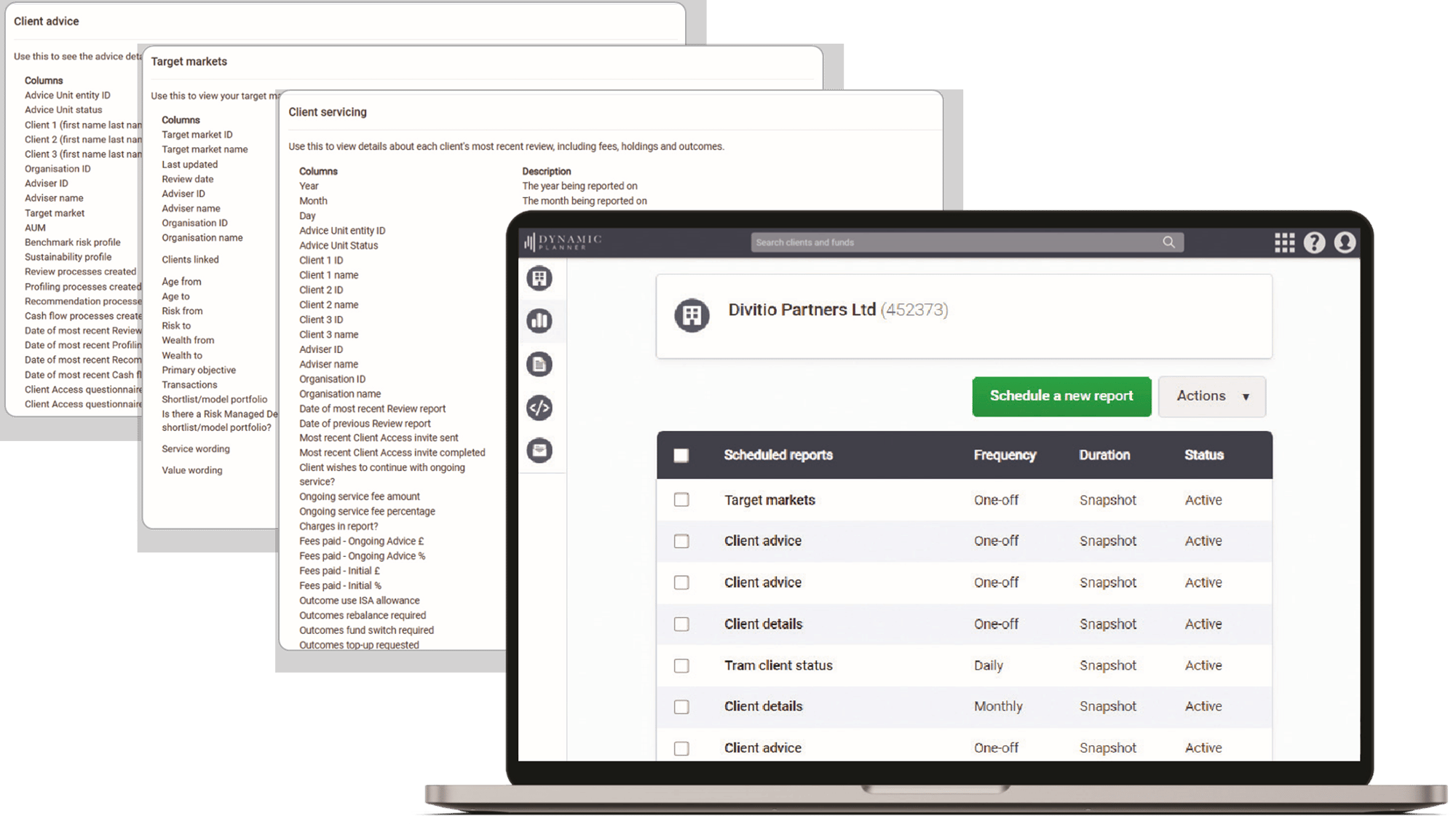

Automated MI for oversight, decision making and compliance

The FCA has highlighted insufficient management information, lack of review evidence and lack of oversight as examples of as poor practices in its ongoing advice review.

Dynamic Planner Insights ensures your firm stays ahead. This powerful MI module provides real-time visibility into suitability reviews carried out, client demographics, profiling, target markets, and advice processes, helping you deliver compliant, data-driven financial planning.

With scheduled or on-demand insights, you can track platform usage, assess client risk and sustainability profiles, monitor client interactions, and generate reports that directly support the FCA's ongoing servicing requirements.

Our stance on the FCA's statement

At Dynamic Planner, we fully support the FCA’s commitment to ensuring ongoing suitability and transparency in financial advice. Meeting these expectations requires robust processes, clear client communication, and accurate record-keeping and that’s exactly where Dynamic Planner can help.

Our Review, MI and reporting tools enable firms to create, oversee, and evidence suitability reviews with ease. With real-time data on client interactions, risk profiling, and investment suitability, you can confidently demonstrate compliance, optimise operations, and deliver high-quality advice, all while ensuring clients receive the service they expect.

How you can meet the FCA's ongoing advice expectations

Understand the FCA’s latest findings for ongoing advice. Explore this page for insights, best practices, and practical guidance to help your firm navigate ongoing advice and meet regulatory expectations.

Ongoing advice review checklist

Download our checklist to ensure you are following the best practices available.

Discover Dynamic Planner

Find out why Dynamic Planner is used by over 45% of UK financial advisers to handle the entire planning process.

Blog: Ongoing advice

Firms may be delivering on their commitment to provide ongoing advice, but is it enough?

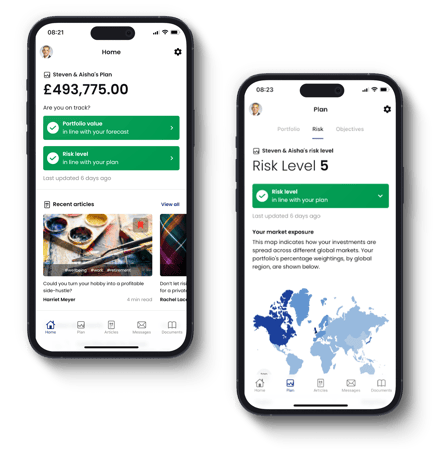

Encourage review responses with Tram, your new mobile app

According to the FCA’s findings, in 15% of cases clients either decline or do not respond to review invitations from their adviser.

This raises the questions of how these clients should be serviced in line with Consumer Duty, and how to increase the proportion of positive responses.

With the largest wealth transfer in history on the horizon, we believe the future of advice is digital. Tram, our client-facing mobile app, has been designed with this in mind. The advantages of an app for client communication are proven, with app notifications 28x times more likely to trigger a response than an email.

Want to see it in action?

Get in touch now to receive a live tailored demo for your business and see how Dynamic Planner can help you exceed your business goals.

Our commentary on ongoing advice in the press

Money Marketing

"Between now and a likely follow up, you’re going to want to get your house in order when it comes to meeting those requirements"

PA Adviser

“We expect there to be further data requests for the financial advice portfolio before the summer... you would be wise to meet those standards before then”